If you are new to markets, you should gain some knowledge before you venture into the equity market. Plus, there are different types of equity market and so you know about them as well. In the following sections, you will know about 12 important things related to Indian equity market. Shareholder equity may also be expressed as the share capital of a company, and earnings retained less the value of treasury stock. Since both strategies yield the same figure, the use of total assets and total liabilities is more representative of the financial health of a company. Equity is the value that is given to a company’s shareholders in terms of finance and accounting.

Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. If an individual has set up a Demat account, he/she can buy the stocks in a few minutes. Generally come with an expiry period of three months and the settlement day is usually the last Thursday of the 3rd month. The difference between the value of the securities in a margin account and the amount borrowed from the brokerage for margin trading.

- The probable returns from these types of investments are substantial whilst their risks are equally enhanced.

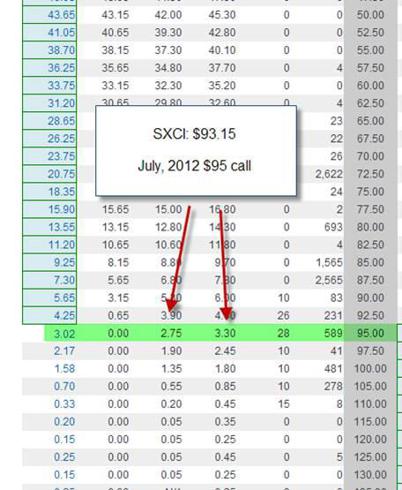

- Year-over-year growth from 2005 to 2006 has risen 30% in e-mini futures and a whopping 134% in the option contracts on those futures.

- Are market-linked investments that do not come with an assurance of bearing fixed returns.

- No fee of whatsoever nature is to be charged for the use of this Website.

- When a company goes bankrupt and has to be liquidated, the amount left over after creditors are paid in equity.

- The equity market is maintained by stock exchanges, and various stakeholders like brokers, dealers, clearing corporations etc.

If you do not close it yourself, the position gets squared off automatically at the market closing price. You don’t get ownership of the stocks you buy and sell in intraday trading. The goal of intraday trade is not to own the stocks; it is to make profits by reaping the benefit of price movements during the day. Investing in equity mutual funds comes at slightly higher risk as compared to debt mutual funds, but they also give your money a chance to earn higher returns. Now that you know more about different types of equity mutual funds, what are you waiting for? This individual can further earn profits through stock price appreciation or capital gains on investments in the company’s stocks.

There are no charges or fees to be paid by you for use of this Website. However, you are responsible for all telephone access fees and/or internet service fees that may be assessed by your telephone and/or internet service provider. You further agree to pay additional charges, if any levied by Third Party Service Provider, for the facilities provided by them through the Website . Attempt to decipher, decompile, disassemble, or reverse engineer any of the software, comprising or in any way making up a part of the Website or the facilities. Post or transmit any file which contains viruses, worms, Trojan horses or any other contaminating or destructive features, or that otherwise interferes with the proper working of the Website or the facilities. This Website is controlled and operated from India and there is no representation that the Materials/information are appropriate or will be available for use in other locations.

When it comes to stock market investment, equities are nothing but the shares in a corporation’s ownership. In a nutshell, equities are the overall amount of money a shareholder is liable to receive when a company pays off all its debts and further liquidates its assets. Thus, when an individual buys a company’s equities, they become its partial owner. Multi Cap Equity Funds or Diversified Equity Funds invests in stocks of companies across the stock market regardless of size and sector.

Value Added Services

Unless you are 100% sure, do not try to take totally contrarian bets. APIC, which is categorised on a balance sheet under shareholder equity , is considered a profit potential for businesses because it results in excess cash from stockholders. Preferred shares are available in various configurations, including convertible, retractable, and variable-rate preferred shares. One disadvantage of preferred shares is that the majority of them are non-voting. However, when a specified number of preferred dividends is withheld, preferred shareholders typically receive voting rights.

What is equity cash payout?

What Is Equity Compensation? Equity compensation is non-cash pay that is offered to employees. Equity compensation may include options, restricted stock, and performance shares; all of these investment vehicles represent ownership in the firm for a company's employees.

In finance, a forward contract or simply a forward is a non-standardized contract between two parties to purchase or to sell an asset at a specified future time at an quantity agreed upon today, making it a type of spinoff instrument. This is in distinction to a spot contract, which is an agreement to buy or promote an asset on its spot date, which can differ depending on the instrument, for example most of the FX contracts have Spot Date two enterprise days from today. However, anyone with adequate collateral to commerce with a bank or hedge fund can purchase a CDS, even consumers who do not hold the loan instrument and who have no direct insurable interest within the loan (these are called “bare” CDSs). By the end of 2007, the outstanding CDS quantity was $sixty two.2 trillion, falling to $26.three trillion by mid-12 months 2010 but reportedly $25.5trillion in early 2012.

What are different categories of Equity Funds

You have additionally seen how non-financial corporations use derivatives to handle risk, in regards to the costs they obtain for the products and companies they sell, or the prices they pay for inputs. For instance, you saw tips on how to use commodity futures and ahead contracts. Despite the nicely-publicized debacles, the growth in derivatives has been nothing wanting remarkable. According to the Chicago Mercantile Exchange , the S&P 500 mini futures contract (one-fifth the scale of the conventional contract) had its 10th anniversary in 2007. While the futures contract specifies a trade going down in the future, the purpose of the futures trade is to behave as middleman and mitigate the risk of default by either party within the intervening interval.

Trade execution takes place at the exchange platform as per the order matching rules of the exchange. Thus there is a possibilty that orders may be executed only partially or may not be executed at all; as is the case with normal cash transactions also. Frequency means the time interval, after the start date, with which you wish SIP orders to be placed in your account.

Some of them are trading in bonds, exchange-traded funds, equities derivatives, futures and options etc. Trading in bonds includes government bonds, investment-grade corporate bonds and high yield bonds. Trading in futures includes trading of equities derivatives, bonds as well as commodities. Derivatives trading have different risk and rewards in comparison to cash equities trading.

Can I hold intraday shares?

Depending on the frequency selected by you, IIFL will place SIP orders at the defined intervals after the start date for the total period specified by you. The First order will be placed on the start date specified by you and thereafter orders would be placed at the frequency for the total period as per your request. Unlike in the cash segment, where you have to time the market to make gains, Equity SIP helps you to bring down your average cost of acquisition of shares due to the averaging principle. Therefore, students who want us to define brand equity should know that it is the value that a company generates.

The dividend income act as a source of income for the shareholders of the company. It would not be wrong to say that dividend is one of the ways through which an investor earns a return on his investment. The rate of dividend varies from company to company according to their profits.

How To Do Online Equity Trading ?

If the position taken during the day is not closed by the trader, it automatically takes the reverse position at the closing market rate. The trader does not own the shares at the end of the day as the intention of the trader is to book profit based on the movement of the price. Unlike intraday trading, if you buy a share but do not sell it on the same trading day, it is called delivery trading. In delivery trading, the stocks you buy get credited to your Demat.

What are examples of equity?

Equity Example

For example, if someone owns a house worth $400,000 and owes $300,000 on the mortgage, that means the owner has $100,000 in equity. For example, if a company's total book value of assets amount to $1,000,000 and total liabilities are $300,000 the shareholders' equity would be $700,000.

Your Acceptance of the Terms of Use contained herein constitutes the Agreement for the Purpose as defined hereunder. However, the IRR alone does not give enough information to say whether one project should be pursued ahead of another. Settlement of Equity SIP transactions would be done in the same manner as cash transactions. You can view your order placement date in the Equity SIP Registration book under the column ‘Holding’. In case of SIP through bank, IIFL will place the order only after checking that sufficient Money is credited to IIFL through mode of ECS.

Derivatives are extra frequent in the trendy period, but their origins trace again several centuries. One of the oldest derivatives is rice futures, which have been traded on the Dojima Rice Exchange for the reason that eighteenth century. An equity by-product is a monetary instrument whose worth is predicated on fairness actions of theunderlying asset. For instance, a stock optionis an fairness by-product, as a result of its worth relies on the worth actions of the underlying stock. Derivative transactions embrace an assortment of monetary contracts, together with structured debt obligations and deposits, swaps, futures, choices, caps, floors, collars, forwards, and various combos thereof. Many retail buyers equate threat in terms of leverage and market danger and hesitate to understand that leverage works both ways.

How is intraday trading different from regular trading?

The probable returns from these types of investments are substantial whilst their risks are equally enhanced. Know-how about intraday trading – Before you jump into the stock market bandwagon by listening to random tips, it would be better to know how to do intraday trading for better results with your trades and investments. The equity market is maintained by stock exchanges, and various stakeholders like brokers, dealers, clearing corporations etc. It is an extended family of institutions and this is the true equity market meaning.

Lock products obligate the contractual events to the terms over the life of the contract. Option merchandise provide the buyer the right, however not the obligation to enter the contract under the terms specified. The belongings include commodities, stocks, bonds, interest rates and currencies, however they can also be different equity cash meaning derivatives, which provides another layer of complexity to proper valuation. These funds are readily available to invest in several sectors and market capitalisations. A Rs 1000 stock is not expensive and a Rs 5 stock is not cheap – Some investors approach equity investing in the same way they buy clothes or vegetables.

What is equity vs cash?

Cash is a liquid asset transferred in and out of the investment. When you have positive cash flow, you can transfer the surplus immediately into another investment vehicle, such as stock, or use it to increase your real estate portfolio. Equity, on the other hand, is tied to the value of the property itself.

Traders will use a futures contract to hedge their danger or speculate on the price of an underlying asset. The celebration agreeing to buy the underlying asset in the future assumes an extended place, and the celebration agreeing to promote the asset sooner or later assumes a short position. The value agreed upon known as the supply value, which is equal to the forward worth at the time the contract is entered into.

Generally, individual traders do not have access to this facility. In relation to real estate, the amount of property’s value that is not borrowed against a mortgage or line of credit. The Website specifically prohibits you from usage of any of its facilities in any countries or jurisdictions that do not corroborate to all stipulations of these Terms of Use. In case of any dispute, either judicial or quasi-judicial, the same will be subject to the laws of India, with the courts in Mumbai having exclusive jurisdiction. Either party can terminate this Agreement by notifying the other party in writing. Upon such termination You will not be able to use the facilities of this Website.

Is equity cash on hand?

Stockholders' equity includes a company's assets and liabilities, while cash on hand only represents the company's cash.

Recent Comments