Content

You will need to pay a registration fee and testing fee for the Prometric testing center costs. You will still have a small fee to deal with, but you will not lose your notice to reschedule. You simply need to contact NASBA within 48 hours of the missed exam, and they will allow you to reapply for a new notice to schedule. As a CPA, you can’t let everything you learned how much does cpa exam cost for your education and exam requirements slip away. And, you’ve got to stay up to date with the latest changes in the industry. I feel like a broken record saying this, but once again, how much CPE you need will depend on your state. Most states require you to complete 40 hours of CPE a year, and one credit hour of CPE can cost anywhere from $20 to $125.

Which is the hardest of the CPA exams?

Among the four sections, FAR has a reputation for being the hardest. It typically has the lowest pass rate. BEC is often thought to be the easiest.

These costs are typically arranged in a tiered fashion allowing you to save money by signing up for multiple sections at one time. There are fees to apply for the exam, and then a fee to take each of the 4 sections. The fees to take each section of the exam also vary by state, but are roughly $200 per section, or $800 for all 4 sections. Application fees range from $10 to $200, depending on the state where you apply to take the exam. Most states have an application fee between $100 and $200, with an average around $130.

CPA Exam Review Course Cost

This means you will have to schedule all four exams within that period or risk having to pay your registration fees again. Although the CPA Exam cost may seem high, it is important to schedule your exams based on your preparedness and NTS, not to save on CPA Exam costs.

Indiana CPA Society Helps Pass Rule Change for Future CPAs – CPAPracticeAdvisor.com

Indiana CPA Society Helps Pass Rule Change for Future CPAs.

Posted: Wed, 02 Nov 2022 07:00:00 GMT [source]

This is not uncommon and everyone from medical doctors to educators are required to stay current through ongoing training. If you move to a different state, you will probably have to pay fees to your new home state. Zolpidem Depending on the nature of your practice, at some point you may have to pay a state board https://www.bookstime.com/ a reciprocal CPA license fee or pay for a reinstatement of your CPA certification or license. Generally, you will be able to apply online, pay fees, and have your eligibility validated for one year. In many states, the NASBA International Evaluation Services is the only provider of this validation.

CPA Exam Cancellation Fees and Refunds

Most states that allow international candidates to take the exam in their jurisdiction charge a $150 – $200 fee for this extra review. The first of the CPA exam costs is the application fee. However, it is important to remember that your state may specify a different validity period for the NTS. Therefore, you should check this before you pay your registration fees. Of course, you have to pass all four sections of the CPA exam first. Additionally, you have to be prepared to pay several thousand dollars in fees and costs. If you choose to reschedule your exam date within 30 days of your chosen date, there are fees for rescheduling.

Follow these steps to make sure your application process goes smoothly the first time. This is the fee that you pay to your state board in order to apply to take the exam. It’s only a one time fee, but you might end up paying it more than once if your application is rejected the first time or you let your authorization to test notice expire. The Continuing Professional Education Program conducted by the AICPA ensures that you maintain your professional competence and knowledge after passing the exam. You can view the CPE requirements of different states on the NASBA website and also see how much the various courses will cost. The different states charge varying levels of CPA licensing fees.

How Tabitha Passed Her CPA Exams After Years of Struggling

If you don’t do so, you’ll have to pay the exam fees as well as the registration fees all over again in order to obtain a new NTS. The fees will vary based on how you earn these credits. Depending on your state hourly CPE requirements, you may pay $1,000 or more per year for continuing education. The CPA exam registration fees vary from state to state, but they typically range from $115 – $175 per section. You can also sign up for multiple sections at the same time to get a bit of discount. After you pay your examination fees, you can officially sign up to take a CPA exam section.

These costs also vary by state, and range from $50 to $300. After you receive your NTS, you need to contact Prometric through their website and arrange for a seat at the examination site of your choice. You should schedule as far in advance as possible, and must schedule at least five days in advance. To increase the likelihood that you will receive your first choice for site location and time, you should schedule your examination 45 days in advance. Your NTS is valid for a specific amount of time, which varies by state. If you do not sit by the expiration date on the NTS, that NTS becomes invalid and cannot be used.

Education Requirements

After CPA licensing, most states require CPAs to complete continuing professional education credit hours to maintain licensure. Be sure to check with your State Board of Accountancy to find out how many hours are required each year to maintain your credential. After you have successfully completed all four sections of the CPA exam and you have completed the AICPA ethics exam, you will need to pay your CPA licensing fees to your state board. This includes a study book and all fees required to take the exam. Due to this pricing model, the registration fee varies significantly by state and by candidate.

- To actually sit for the CPA exam, you will pay another fee.

- These courses are designed to help you accelerate your progress and pass the CPA exam on the first try.

- The different states charge varying levels of CPA licensing fees.

- After becoming a fully licensed CPA, you will need to complete a certain number of continuing education hours per year to maintain your license.

- You must schedule your appointment at least five days in advance, but it is recommended to schedule your examination 45 days in advance.

- CPA candidates are only eligible for one NTS extension or a partial refund for an NTS for the same hardship.

- You must sit for the examination before your NTS expires.

You must pass the 50 multiple-choice questions exam with at least a 90 percent or higher score within 2 years of applying for a CPA license. You must also complete a second core of 20 semester hours of “accounting study” beyond the standard course mentioned above.

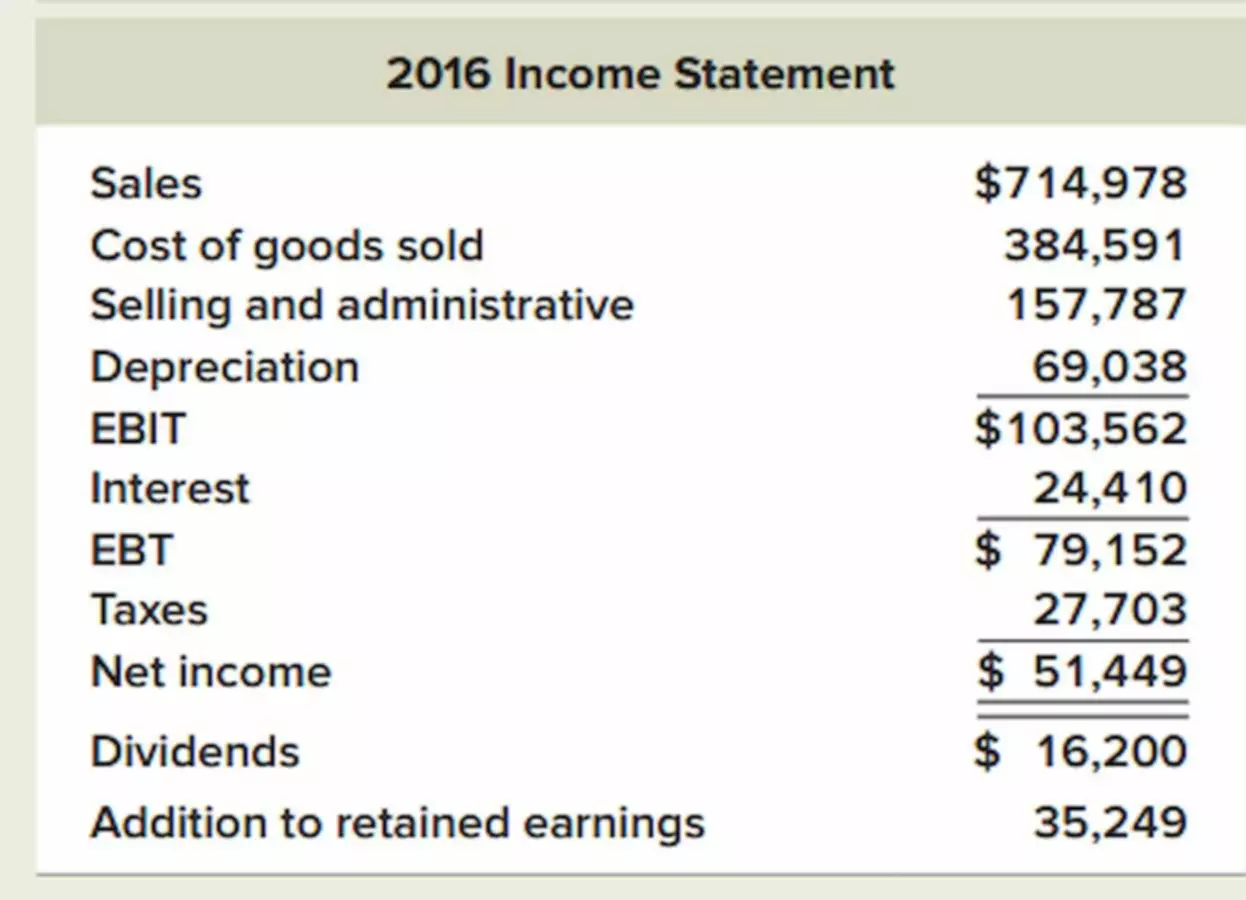

CPA Exam Cost Chart

Because this is an investment, you should feel locked into your exam date. This may incentivize you to stick to your study schedule so that you can pass all four sections without having to retake anything. If you want to make the above-average pay of a certified public accountant, it’s worth it to invest in the CPA exam. This article will help you understand everything you can expect to spend along the way. Most states require CPA candidates to complete an ethics exam after they pass all four sections of the CPA exam. The CPA examination fees vary by state, but they are typically around $200 per section. Once NASBA approves your application, you will be given a Notice to Schedule that allows you to register for the exam section within the next six months.

Recent Comments